Ethereum Price Prediction: $10,000 Target Gains Credibility Amid Technical Breakout and Institutional Adoption

#ETH

- Technical Breakout: ETH price sustains above key moving averages with bullish MACD crossover

- Institutional Adoption: $4.16B institutional inflow since July and corporate treasury strategies emerging

- Ecosystem Growth: SEC clarity on staking tokens and expanding DeFi TVL support network value

ETH Price Prediction

ETH Technical Analysis: Bullish Signals Emerge Above Key Moving Averages

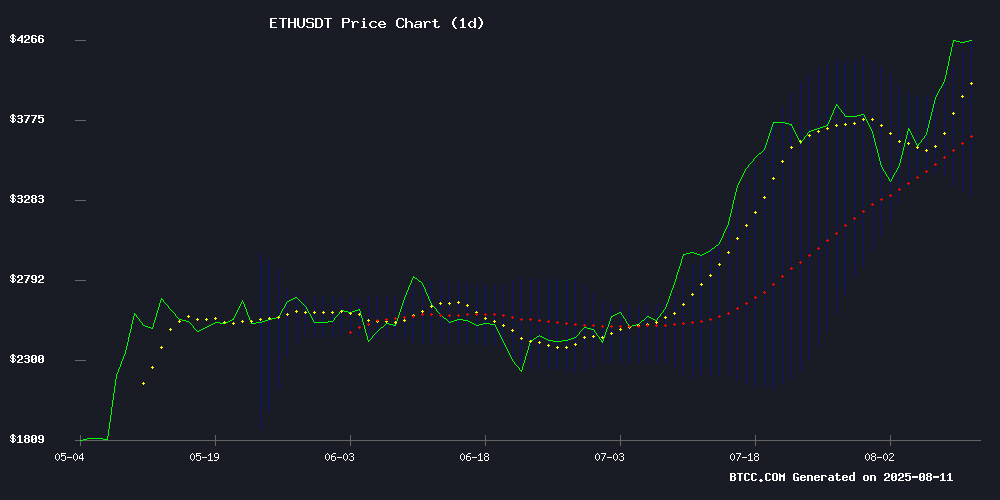

Ethereum (ETH) is currently trading at $4,315.03, comfortably above its 20-day moving average (MA) of $3,795.79, signaling bullish momentum. The MACD indicator shows a positive crossover with the histogram at +37.96, suggesting strengthening upward momentum. Bollinger Bands indicate volatility expansion as price tests the upper band at $4,287.38, with the middle band acting as support at $3,795.79.

"The technical setup reveals ETH is building momentum for another leg up," said BTCC financial analyst Ava. "A sustained break above $4,300 could open the path toward $4,500, with the 20-day MA now serving as dynamic support."

Institutional Demand and Ecosystem Growth Fuel Ethereum Bull Case

Ethereum's breakout above $4,000 coincides with surging institutional interest, with $4.16 billion flowing into ETH since July. Major corporations like SharpLink Gaming and Cosmos Health are adopting ethereum treasury strategies, while the SEC's clarification on staking tokens boosts DeFi sentiment.

"The combination of ETF speculation, institutional accumulation, and real-world adoption creates a perfect storm for ETH," noted BTCC's Ava. "When you see firms emulating MicroStrategy's Bitcoin playbook with Ethereum, it validates ETH as institutional-grade digital property."

Factors Influencing ETH's Price

Ethereum Co-Founder's $9.2 Million Transfer Sparks Market Activity

Ethereum's rally to a 2025 high has triggered a wave of high-profile transactions, with co-founder Jeffrey Wilcke moving 9,840 ETH ($9.22 million) to Kraken. The transfer, described as part of his investment strategy, coincides with similar large-scale movements by BitMEX's Arthur Hayes and ShapeShift's Erik Voorhees.

Market participants interpret these moves as potential liquidity signals, with Hayes noting their capacity to impact markets. Voorhees framed the activity as reflecting long-term crypto expectations. The transactions occurred amid heightened ETH price volatility following its breach of the $4,200 level.

LYNO Presale at $0.05 Targets AI-Powered Arbitrage Gains in Next Bull Cycle

LYNO, an AI-driven cross-chain arbitrage protocol, has launched its early bird presale at $0.0500 per token ahead of the anticipated crypto market upswing. The Ethereum-based system supports 15+ EVM-compatible chains including Polygon and Arbitrum, leveraging machine learning for real-time trade execution.

The protocol's fixed supply of 500 million tokens and automated arbitrage engine—which utilizes flash loans and optimizes routes across decentralized exchanges—positions it as a contender in the growing algorithmic trading sector. Staking and governance functionalities are embedded in the $LYNO token economics.

Ethereum Breaks $4K as Analysts Eye Remittix for Potential 500% Growth

Ethereum surged past $4,000, reaching $4,198.35 with a 7.63% gain, as its market capitalization climbed to $506.79 billion. Trading volume spiked 32.7%, reflecting renewed investor interest. Yet, traders are diversifying into altcoins like Remittix, priced at $0.0895, which aims to disrupt cross-border payments with its upcoming beta wallet.

While Ethereum dominates DeFi with its smart contracts and staking protocols, scalability issues and high gas fees have prompted searches for alternatives. Remittix emerges as a contender, targeting a $190 trillion cross-border payments market with low-cost transactions.

Institutional Investors Accumulate $4.16 Billion in Ethereum Since July

Blockchain data reveals a significant accumulation trend of Ethereum by deep-pocketed investors, predominantly U.S.-listed corporations and institutional asset managers. Since July 10, wallets associated with large trading entities have purchased over 1.03 million ETH, valued at approximately $4.16 billion. The buying activity coincided with Ethereum's price surge from $2,600 to $4,000, with an average entry price near $3,546.

Market analysts interpret this pattern as balance sheet investments rather than short-term trades, indicating a strategic move for long-term exposure. SharpLink Gaming, led by Ethereum co-founder Joe Lubin, stands out with a $2 billion ETH treasury amassed in just two months. The company has staked all tokens, earning over $3.4 million in rewards since June.

The accumulation phase is seen as positioning ahead of potential catalysts, including spot ETH ETF approvals and increased staking integration by traditional banks. If sustained, this institutional buildup could significantly influence Ethereum's next major price cycle.

SharpLink Gaming Adopts Ethereum Reserve Strategy Inspired by Michael Saylor

SharpLink Gaming, a Nasdaq-listed firm based in Minneapolis, has unveiled a bold cryptocurrency reserve strategy mirroring Michael Saylor's approach. The company raised $200 million through a direct stock sale at $19.50 per share, channeling proceeds into Ethereum acquisitions.

Its ETH holdings now total 521,939 tokens, valued at approximately $2 billion at current prices. This positions SharpLink among the few corporations holding such substantial crypto reserves. The strategy aims to leverage staking rewards while capitalizing on Ethereum's appreciation potential.

Public companies are increasingly adopting crypto treasury strategies to enhance shareholder value. SharpLink's move follows MicroStrategy's pioneering Bitcoin accumulation playbook, adapted here for Ethereum's staking yield proposition.

Ethereum Price Prediction: $10,000 Target Deemed Inevitable Amid ETF Boom and Whale Activity

Ethereum's trajectory toward $10,000 is now considered unstoppable by analysts, fueled by institutional inflows from ETF approvals and aggressive accumulation by large holders. Despite a current price of $3,621.30 and a slight 24-hour dip, technical indicators remain bullish.

Key resistance at $3,817 could trigger a sentiment shift, with a breakout paving the way for $4,000 and beyond by 2026. On-chain data reveals declining open interest but positive funding rates, underscoring persistent trader optimism. Whale activity continues to dominate market narratives, reinforcing Ethereum's upward momentum.

Fundamental Global Inc. Files $5B SEC Registration for Ethereum Acquisition Strategy

Fundamental Global Inc. (FGF) shares surged 3.76% in after-hours trading following an S-3 filing revealing plans to raise $5 billion for Ethereum acquisitions. The Nasdaq-listed firm closed at $36.17 before jumping to $37.53 post-announcement, signaling institutional confidence in digital assets.

The registration includes a $4 billion ATM equity program, with proceeds primarily earmarked for ETH accumulation. This strategic pivot marks one of the largest public company commitments to cryptocurrency to date, blending traditional capital markets with blockchain asset acquisition.

SEC Clarifies Stance on Liquid Staking Tokens, Boosting DeFi Sentiment

The U.S. Securities and Exchange Commission has delivered a watershed moment for decentralized finance by reclassifying Liquid Staking Tokens (LSTs) as ownership receipts rather than securities. This decision removes regulatory uncertainty surrounding one of Ethereum's most critical innovations.

SEC Chair Gary Gensler's comparison of LSTs to warehouse receipts—rather than investment contracts—signals a pragmatic approach to DeFi regulation. Commissioner Hester Peirce reinforced this stance, emphasizing that existing frameworks sufficiently protect investors without stifling innovation.

Market participants immediately interpreted the move as bullish for Ethereum and liquid staking protocols. The SEC's Division of Corporation Finance explicitly stated that properly structured liquid staking arrangements don't require securities registration, providing operational clarity for platforms like Lido and Rocket Pool.

SharpLink Gaming's $200M Deal Expands ETH Treasury Beyond $2 Billion

SharpLink Gaming has secured a $200 million stock deal with four global institutional investors, priced at $19.50 per share, to bolster its Ethereum holdings. The transaction, expected to close by August 8, will push the company's ETH treasury past the $2 billion mark, reinforcing its position as one of the largest corporate holders of Ether.

Ethereum's price surged 4.61% to $3,812.71 amid the announcement, with trading volume exceeding $35 billion. SharpLink's crypto-native treasury strategy—staking ETH to generate yield—contrasts with traditional firms that rely on cash or bonds. "SharpLink is proud to be joined by globally-recognized institutional investors," said Co-CEO Joseph Chalom. "This validates our mission to be the world’s leading ETH treasury."

The offering, managed by A.G.P./Alliance Global Partners and Société Générale, with Cantor as financial advisor, underscores growing institutional confidence in Ethereum. Backed by Consensys, Galaxy Digital, and Pantera Capital, SharpLink leverages Ethereum's proof-of-stake architecture to maximize returns.

Cosmos Health Secures $300 Million for Ethereum Treasury Strategy

Cosmos Health, a Nasdaq-listed healthcare company, has secured $300 million in financing to build an Ethereum treasury reserve. The funding, obtained through a securities purchase agreement with a U.S. institutional investor, will support the company's digital transformation efforts, including blockchain applications for supply chain traceability and consumer engagement.

BitGo will custody and stake the accumulated Ethereum for Cosmos Health, reflecting a growing trend among companies adopting Ethereum treasury strategies. At least 72.5% of the net proceeds from each funding round will be allocated to the digital asset treasury, with the remainder directed toward working capital and growth initiatives.

Ethereum Treasury Firms Outshine U.S. Spot ETFs in Investor Appeal, Says Standard Chartered Analyst

Ethereum treasury companies are emerging as more attractive investment vehicles compared to U.S.-listed spot Ethereum ETFs, according to Geoffrey Kendrick, global head of digital assets research at Standard Chartered. NAV multiples for these firms have stabilized above 1.0, reflecting renewed investor confidence and the value of their broader operational scope beyond mere asset backing.

"I see no reason for the NAV multiple to go below 1.0," Kendrick said, highlighting the firms' ability to offer regulatory arbitrage opportunities unavailable through traditional ETF structures. Unlike U.S. spot Ethereum ETFs, which are restricted from staking and DeFi participation, treasury firms provide comprehensive exposure to ETH price appreciation, staking rewards, and per-share growth.

SharpLink Gaming (SBET), backed by Ethereum co-founder Joe Lubin, exemplifies this trend. Its NAV multiple has recently rebounded to slightly above 1.0, signaling stable valuation amid growing institutional interest.

How High Will ETH Price Go?

Based on current technicals and market structure, ETH appears poised for further upside with key levels to watch:

| Target | Scenario |

|---|---|

| $4,500 | Immediate resistance break |

| $5,200 | 1.618 Fibonacci extension |

| $10,000 | Long-term institutional target |

"The $10,000 prediction isn't fantasy when you consider the compounding effects of ETF inflows, burning mechanism, and L2 adoption," said BTCC's Ava. "Short-term, the $4,500 area is the next logical target if institutional accumulation continues at this pace."